Are you struggling with overwhelming debt and seeking ways to reduce your financial burden? You’re not alone! Every day, thousands look for solutions to cut down their debt and avoid bankruptcy. One of the most effective strategies is debt settlement, where you can potentially reduce your total debt and start your journey toward financial freedom. Recently, I helped clients save over $2,000 on their credit card debt through expert negotiation, giving them a fresh start and relief from high payments. In this article, I’ll walk you through how debt settlement works, why it’s beneficial, and how you can achieve similar savings.

What Is Debt Settlement?

Debt settlement is a process where I negotiate directly with creditors to lower the total amount owed. Instead of paying off the full balance, you pay a reduced lump sum, which can save you thousands of dollars. This solution is ideal for those dealing with credit card debt, medical bills, payday loans, and other forms of unsecured debt.

Real Results: Saving a Client Over $2,000

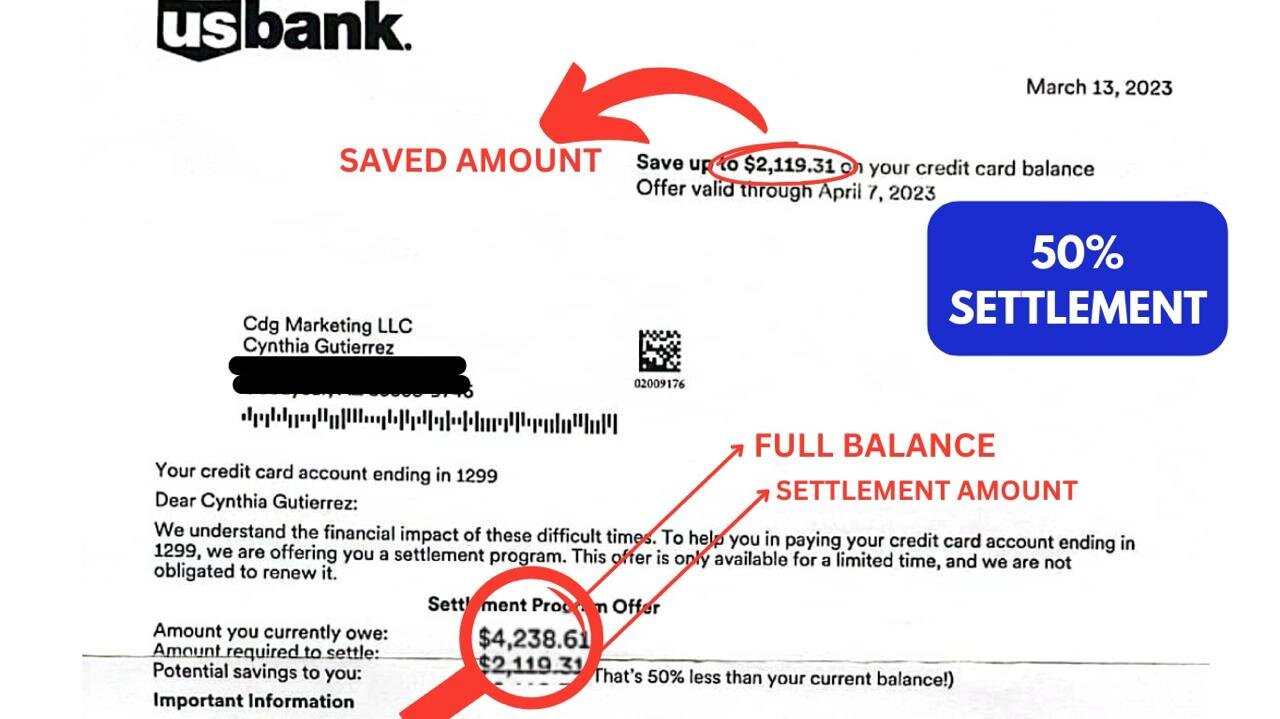

When a recent client approached me, they had a credit card debt of $4,238.61 and were feeling overwhelmed. After careful negotiation, I managed to settle the debt for 50% of the original balance — that’s a payment of only $2,119.31. This allowed my client to save $2,119.31, providing immediate relief and freeing up resources to focus on other financial goals. This case is just one example of how debt settlement can make a big difference.

Why Choose Debt Settlement?

Debt settlement is an effective alternative for people who can’t keep up with minimum payments and need a manageable solution. Here are a few reasons why debt settlement might be the right choice for you:

- Significant Savings: By reducing the principal balance, debt settlement offers immediate financial relief and can save you thousands.

- Avoid Bankruptcy: For those searching for ways to avoid bankruptcy, debt settlement provides a viable solution that doesn’t have the same long-term impact on your credit score.

- Reduce Stress: Living with debt can be stressful. Regaining control of your finances and peace of mind can be helped by settling debt.

Common Questions About Debt Settlement

1. How Does Debt Settlement Affect My Credit Score?

Debt settlement can temporarily affect your credit score, but it’s often worth the impact for the relief it brings. With careful financial planning, you can rebuild your credit over time.

2. How Long Does It Take?

Each case is unique, but negotiations typically take a few weeks to a few months. However, the end result is often worth the wait.

3. Is Debt Settlement Right for Me?

Debt settlement is best suited for those who owe more than they can afford to repay and want a reduced amount to settle their debt.

How You Can Get Started with Debt Settlement

If you’re ready to start your journey toward debt freedom, consider working with a debt settlement expert like me. With my experience in debt negotiation, I can help reduce your balances, save you money, and support you as you take control of your finances.

Simply contact us today, and let’s discuss how we can help you achieve real savings and a fresh financial start!

Conclusion

Debt settlement isn’t just a quick fix — it’s a powerful strategy for long-term financial stability. The savings I achieved for my client, over $2,000 on a single account, show how effective this approach can be. If you’re tired of carrying the burden of debt, reach out today, and let’s work together to get you on the path to financial freedom.